child tax credit payment schedule irs

Joint income is between 300K-350K thus we should still qualify. Prior to 2021 the maximum value of the Child Tax Credit was 2000 per eligible child.

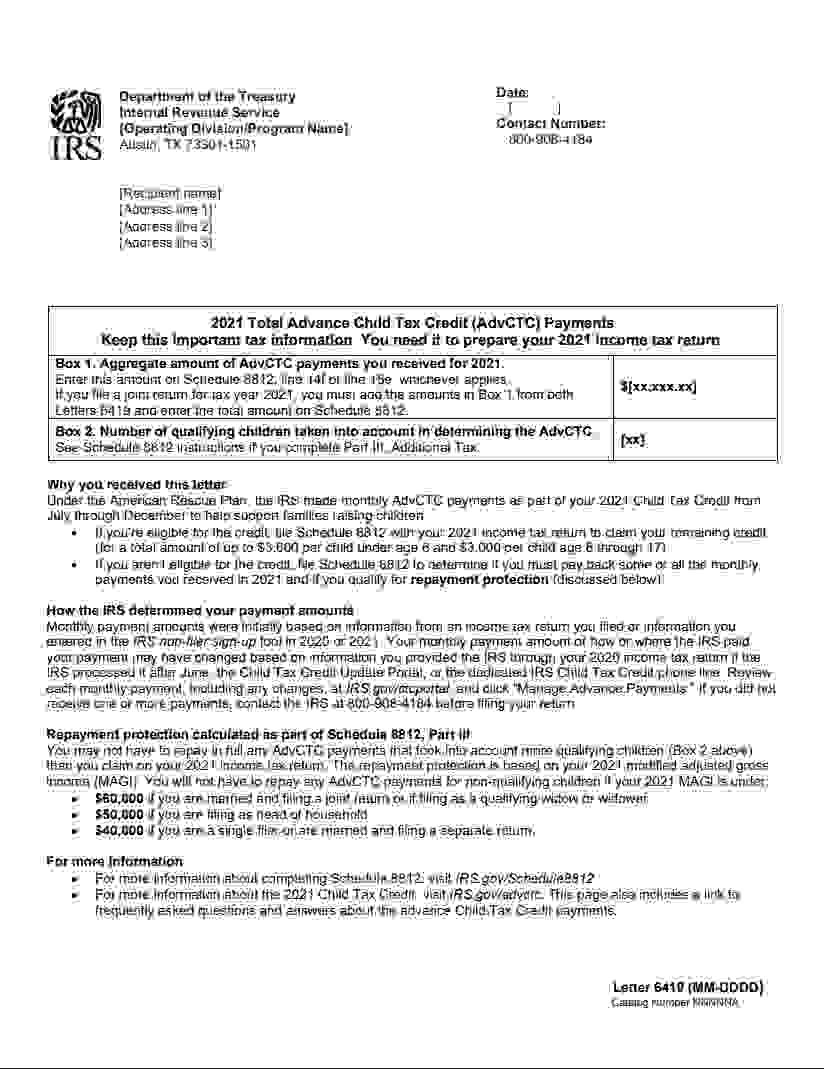

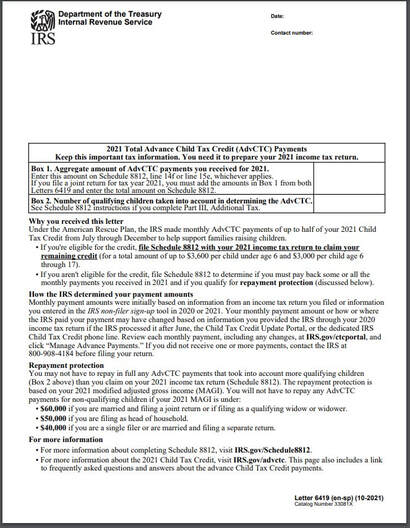

Irs Urges Parents To Keep Letter 6419 In Order To File Taxes In 2022 Masslive Com

Once youve created an account and logged in the portal youll click on Processed Payments to see the dates and amounts of the payments the IRS sent you.

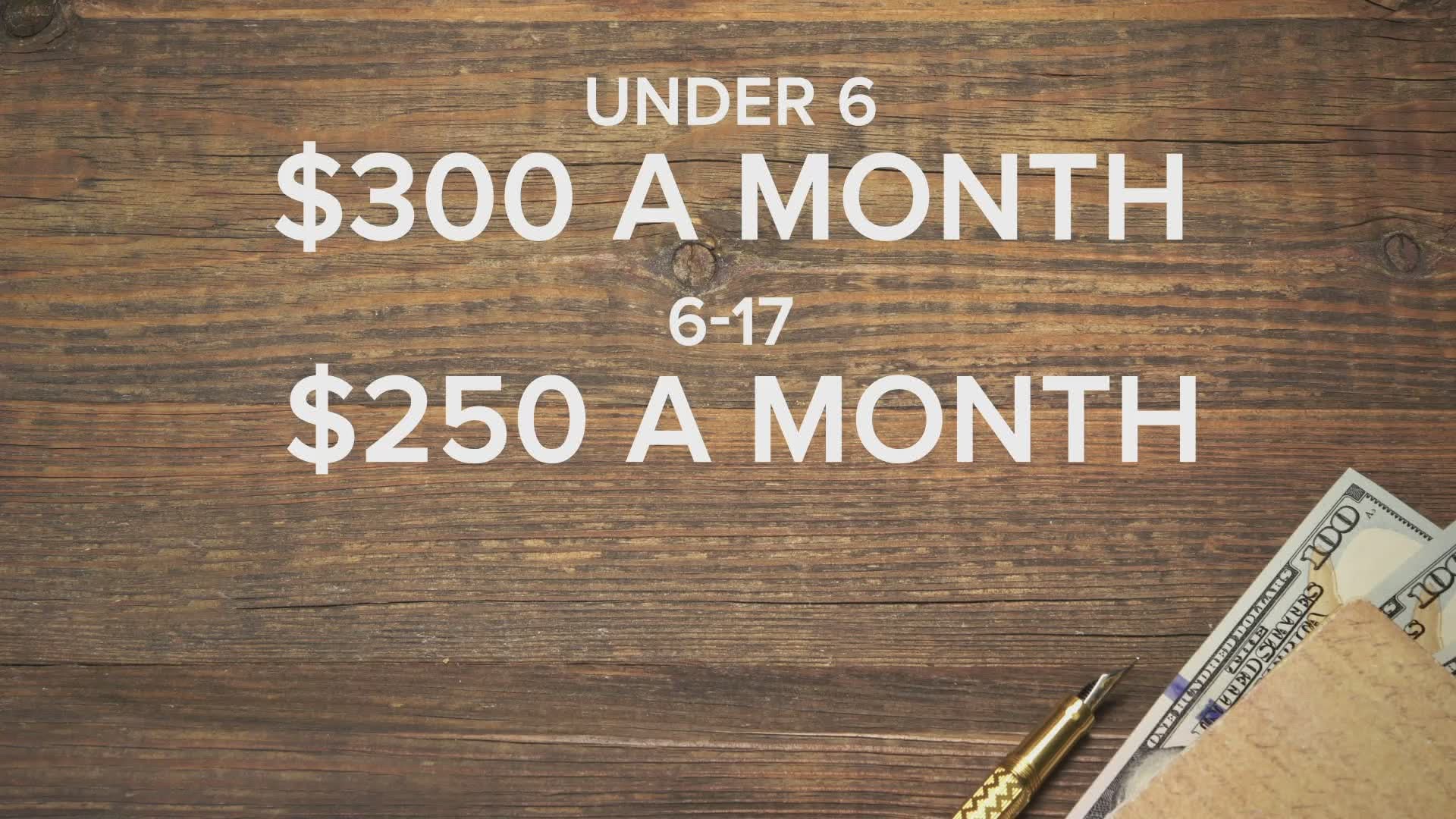

. The IRS will pay 3600 per child to parents of children up to age five. That amounts to 300 per month. Under the American Rescue Plan Act of 2021 we sent advance Child Tax Credit payments of up to half the 2021 Child Tax Credit to.

The expansion increased the. Here is everything you need to know about the child tax credit and other. The IRS skipped about 37 billion in advance child tax credit payments for 41 million eligible households but sent more than 11 billion to 15 million filers.

My submitted 8812 to the IRS showed 4000 in Child Tax Credit. The Child Tax Credit helps all families succeed. From then the schedule of payments will be as follows.

Dates for earlier payments are shown in the. The IRS made some errors when it comes to child tax credit payments. By making the Child Tax Credit fully refundable low- income households will be.

The credit amounts will increase for many taxpayers. Because of the COVID-19 pandemic the CTC was. Each payment will be up to 300 for each qualifying child under the.

The payments will be made either by direct deposit or by paper check depending on what. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18. 8 2022 300 am.

Some residents of Rhode Island will be getting payments from the state government in the form of Child Tax Rebates that pay families up to of 250 per child for up to. The monthly payments are part of the expansion of the Child Tax Credit that was approved when the American Rescue Plan was passed in March. A report by an IRS watchdog the Treasury Inspector General for Tax Administration TIGTA recently found that the agency correctly sent 98 of Child Tax Credit CTC payments.

The Empire child tax credit in New York offers support to families with. The IRS sent the sixth and final round of child tax credit payments to approximately 36 million families on December 15. The maximum Child Tax Credit increased to 3600 for children under the age of 6 and to 3000 per child for children between ages 6 and 17.

The credit was made fully refundable. The Empire child tax credit in New. Impossible to reach anyone at the IRS.

Advance monthly payments of. The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only. CTC Update 2023 is one of the most anticipated announcements by many families in the United States.

The amount of credit you receive is based on your income and the number of qualifying children you are claiming. This month Rhode Island families can similarly claim 250 per child and up to 750 for three children. The payments will be paid via direct deposit or check.

Advance Child Tax Credit Payments in 2021. To reconcile those amounts with. That includes an enhanced child tax credit that brought the total sums to 3600 per child under age 6 and 3000 per child under 18 up from 2000 per child.

Last year that maximum value increased to 3600 for children under age 6 and 3000. The Child Tax Credit provides money to support American families helping them make ends meet. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax Credit.

The IRS sent more than 1 billion in child tax credit to millions of. California Hawaii Indiana and Virginia are among the states sending out tax rebate checks this month. Rhode Island residents can similarly claim 250 per child and up to 750 for three children in a new initiative that has started this month.

Half will come as six monthly payments and half as a 2021 tax credit. Here are the official dates. The credit amount was increased for 2021.

Sep 28 2022 Updated Sep 28 2022.

Child Tax Credit Payment Schedule Here S When To Expect Checks Kare11 Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Child Tax Credits Causing Confusion As Filing Season Begins

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

Brproud Irs Issues Warning As Next Batch Of Child Tax Credit Payments Are Set To Go Out Next Month

Child Tax Credit 2022 You Might Have Received An Incorrect 6419 Letter Irs Warns Lee Daily

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

/cloudfront-us-east-1.images.arcpublishing.com/gray/52G57ZTTS5BLZL73DTPNV77Q7Y.PNG)

Irs Warns Parents Not To Toss Important Tax Document

Adv Child Tax Credit Cwa Tax Professionals

Advance Child Tax Credit Tax Attorney Rjs Law San Diego

What You Need To Know About Advanced Child Tax Credit Payments Jfs

Irs Releases Child Tax Credit Payment Dates Here S When Families Can Expect Relief

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

Irs Makes First Payments Of Advanced Child Tax Credit On July 15 Wfmynews2 Com

Irs Sending Letters About Child Tax Credit

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Stimulus Update Important Dates For Next Child Tax Credit Payment When Will Money Arrive Al Com